Our organization’s financial reporting process is labor-intensive, time-consuming, and not producing the insightful reports essential for creating innovative strategies.

Director of Finance & Administration’s assessment of the challenge.

CHALLENGE

Overhaul an accounting system struggling with the lack of a comprehensive design and incapable of producing clear, concise, and insightful financial reports.

SOLUTION

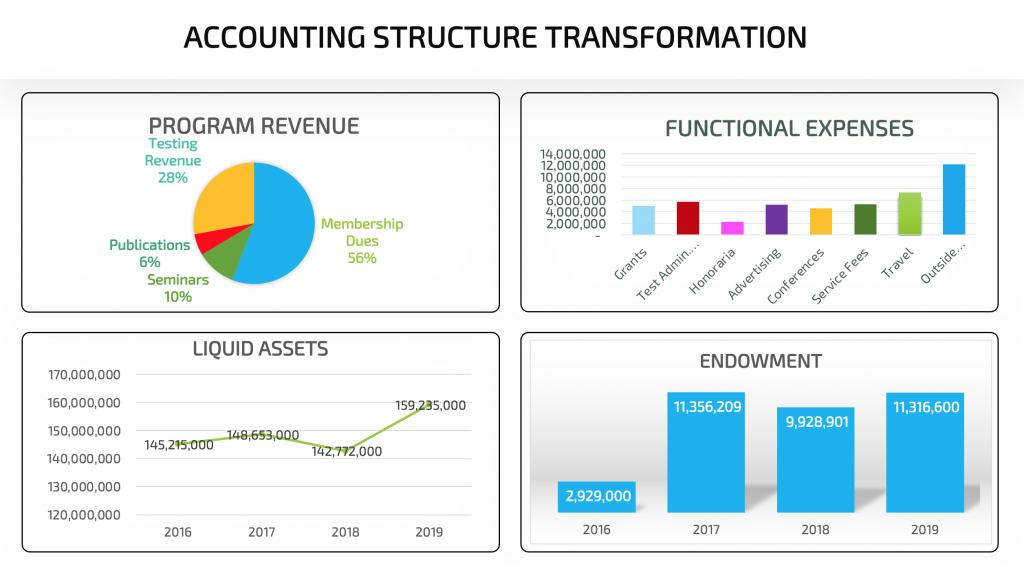

We redesigned the chart of accounts, including adding a program dimension and eliminating hundreds of superfluous accounts.

The manual reporting process was eliminated.

New financial reports were designed that present accurate snapshots of critical programs and the entire organization.

BUSINESS VALUE

During their annual presentation, the outside auditors complimented the Board of Directors on the organization’s expertise in managing finances during the pandemic. The Director of Finance & Administration noted that the clarity of the new financial reports was a significant factor in their success

While the organization recognized an immediate need for system improvements, the in-house resources to execute the upgrades and maintain daily operations simultaneously did not exist. The Director reached out to her peers for consultant references, and an industry colleague recommended my services. We met to discuss the project objectives:

- Create a conclusive comprehensive financial report. The current reports don’t present a concise picture of the organization’s financial status. Multiple pages focus on operating revenues by category and summarize operating expenses to one line. While various pages display different slices of the financial data, they do not reveal a compelling snapshot of the organization or its major programs.

- Streamline and logically rebuild the chart of accounts. The accounting structure’s historical design has resulted in an inconsistently numbered general ledger bloated with excessive accounts. The sheer volume has made coding invoices, analyzing results, and forecasting expenses a protracted ordeal.

- Redesign the reporting process. The current approach consists of exporting the year-to-date account balances to an Excel spreadsheet and mapping the data to the appropriate report lines. Balancing the report to the general ledger is required to validate the mapping formulas. In addition, the Director manually enters the prior year and budget figures into the reporting spreadsheet.

The Director and I outlined the project and agreed that I would execute the transformation in three stages. The initial stage focused on upgrading the manual Excel spreadsheet used to produce the financial reports. I reviewed the existing spreadsheet’s formulas and design and created a new spreadsheet based on my discoveries. The redesigned spreadsheet significantly reduced report preparation time and eliminated manual balancing. We identified the existing general ledger’s strengths and weaknesses during the redesign. We acquired a better conception of the new structure.

During the next stage, I collaborated with the Director of Finance & Administration on the chart of accounts design. The critical innovation was the addition of a program dimension. This gave all programs access to the full range of standard account codes without creating specific program-revenue/program-expense account codes. The duplicate accounts were discarded.

The program dimension enabled the general ledger software to generate program financial statements. It allowed us to eliminate the manual Excel spreadsheet. The year-to-date actuals are downloaded from the software package to an Excel template that includes full financials by organization and programs with comparisons to prior year actuals, forecasts, and budgets. The process is fast and efficient. The Director’s effort is now focused on analyzing results and identifying critical trends.

The final project stage was focused on reconfiguring the data capture systems that feed into the general ledger to begin tracking program-level activity. For example, payroll expenses were recorded by employee. The procedures were updated to start tracking expenses by employee and program. Payroll expenses are now posted to the general ledger at the program level, increasing the accuracy of the program analysis.

The successful transformation of the accounting structure and financial reporting process has resulted in a nimble accounting system that produces innovative financial reports. The organization’s financial status is precisely communicated at both an entity and program level. Board Members, management, and the Director of Finance & Administration can concentrate their efforts on understanding financial results against the backdrop of the economic environment and developing leading-edge strategies.